Series A, B, and C fundraising rounds, which follow "seed funding" and "angel investing," allow outside investors to contribute funds in a developing firm in return for stock or partial ownership. Series A, B, and C financing rounds are all independent fundraising events. The terms are based on the series of shares issued by the capital-seeking firm.

How do Series A, B, and C funding rounds work?

Before delving into how a round of fundraising works, it is vital to identify the various players. First, there are people seeking money for a new company. Businesses often develop through fundraising rounds, starting with a seed round and progressing to A, B, and C rounds.

On the other side, there are possible investors. While investors want firms to flourish because they encourage entrepreneurship and believe in their goals and causes, they also want to see a return on their investment.

As a result, almost all investments made throughout one or more stages of developmental finance are structured such that the investor or investing business keeps some ownership of the company being funded. If the firm expands and makes a profit, the investor will get a return on his or her investment.

Recommeded to read:

- Exit Strategies Unveiled: The USA Entrepreneur's Guide to

- Capital Chronicles: The Ever-Evolving Story of Funding and Exits in the American Business Ecosystem

- In the Green and Out the Door: Navigating Funding and Exits in the USA Market

What is the Funding Valuation?

Analysts do a business valuation prior to fundraising rounds. Management, growth expectations, forecasts, capital structure, market size, and risk are all elements that influence valuations.

Investors have their own approach for valuing a company, although many employ some of the same factors:

- Market size: The size of the market in which the firm operates, measured in dollars.

- Market share: How much of the market the firm makes up, such as 0.10% of the total market.

- Revenue: An estimate of the company's current and future earnings. This is market size multiplied by market share.

- Multiple: Typically, an estimate used by the investor to give them an indication of the business's worth, such as 10x or 12x the revenue.

- Return: The rise in value, expressed as a percentage of the amount invested, based on estimations of market share, market size, and revenue.

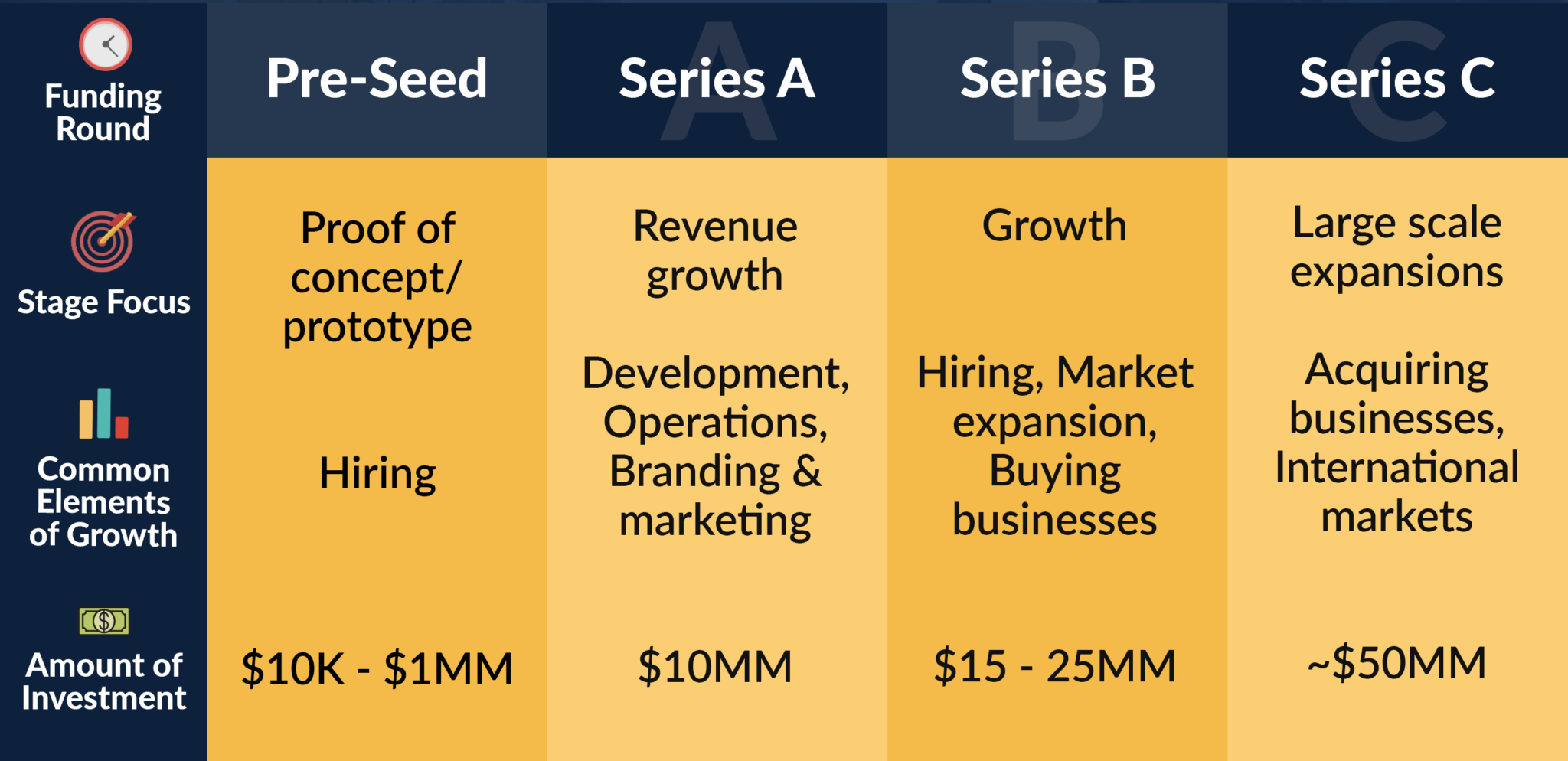

Pre-Seed Funding

The first step of supporting a new firm occurs so early in the process that it is not often included in investment rounds. This stage, sometimes known as "pre-seed" investment, usually occurs when a company's founders begin operations. The most prevalent "pre-seed" financiers are founders, close friends, supporters, and family members.

Depending on the nature of the firm and the early expenditures of establishing the business concept, this fundraising step might be completed quickly or slowly. It is also possible that investors at this point are not investing in exchange for shares in the firm.

Seed Funding

Seed investment is the first equity fundraising round. It is usually the first formal funding for a new business endeavor or firm. Some firms never go beyond seed capital to Series A or beyond.

Seed investment enables a firm to finance its first stages, such as market research and product development. Seed money helps a firm determine what its ultimate goods will be and who its target audience is. Seed cash is often utilized to hire a founding team to carry out these responsibilities.

What Is Series A Funding?

Series A investment is the first round after the seed stage. The phrase refers to the preferred stock that is offered to investors at this stage. In this round, it's critical to have a strategy for creating a business model that will provide long-term profits.

Series A rounds typically generate $2 million to $15 million, however this figure fluctuates depending on the conditions. From January 1, 2023 to May 29, 2023, the average Series A fundraising amount was $22 million.1

In Series A investment, investors seek for more than simply exceptional ideas. Rather, they are searching for startups that have exceptional ideas and a solid plan for turning them into profitable businesses. As a result, businesses in Series A fundraising rounds are often valued (pre-money) at up to $50 million.1

The investors in the Series A round are from more typical venture capital companies. Sequoia Capital, IDG Capital, Google Ventures, and Intel Capital are among the well-known venture capital companies that provide Series A financing.1

How Series A Funding Works.

By this point, it is usual for investors to participate in a more political process. It is normal for a few venture capital companies to dominate the pack. In reality, a single investment might operate as a "anchor." After securing its initial investor, a firm may find it simpler to attract subsequent investors. Angel investors also contribute at this level, although their impact is significantly lower than at the seed investment stage.

Companies are increasingly using equity crowdfunding to raise funds as part of their Series A investment round. Part of the reason for this is that many firms, even those that have successfully raised seed capital, struggle to inspire investor interest during a Series A investment round. Indeed, less than 10% of seed-funded startups will obtain Series A capital.1

What Is Series B Funding?

Series B rounds aim to advance enterprises beyond their development stage. Investors help companies get there by growing their market reach. Companies that have completed seed and Series A investment rounds have already built sizable user bases and shown to investors that they are ready for success on a wider scale. Series B capital is utilized to expand the firm and satisfy these levels of demand.

Read also:

- 5 Basis for Partnerships in Your Company

- TYPES OF FUNDING FOR STARTUPS

- Best Crowdfunding Sites of 2024

- Basics of Initial Public Offerings: An Overview

What Is Series C Funding?

Businesses that obtain Series C capital are already quite successful. These firms seek more money to help them create new products, enter new markets, or buy other companies. In Series C rounds, investors provide cash to successful firms with the expectation of receiving more than twice the amount back. Series C finance is focused on expanding the business as swiftly and profitably as feasible.

Acquiring another firm is one option for expanding a business. Consider a business focusing on developing vegetarian alternatives to animal goods. If this firm raises a Series C round of money, it will most likely have already achieved extraordinary success in selling its goods in the US. The company has most likely already met its objectives from coast to coast. Investors are confident in the company's market research and business strategy, leading them to expect it will do well in Europe.

Perhaps this vegetarian startup competes with a significant market share. The opponent has a competitive edge that the company might use. Investors and founders see the merger as a synergistic cooperation, indicating a positive cultural fit. In this situation, the Series C money might be utilized to acquire another firm. As the enterprise becomes less dangerous, more investors participate.

How Series C Funding Works.

In Series C, hedge funds, investment banks, private equity companies, and big secondary market organizations join the aforementioned investors. The reason for this is because the firm has already shown a successful business strategy; these new investors come to the table expecting to put large amounts of money into existing flourishing businesses in order to ensure their own place as business leaders.

Series C is often the last round of external equity capital for a corporation. For the most part, organizations that get up to hundreds of millions of dollars in capital via Series C rounds want to expand internationally.